The cost of top-level ‘Gold’ hospital insurance policies has increased 58% over the past five years. Our taxes subsidise insurers to make health insurance affordable. So what are the insurers doing to fix a system where comprehensive hospital insurance is now a luxury good?

Why, they’re rorting it, of course.

Every year, health insurers must seek government approval to increase their premiums. But the insurers only need approval to raise premiums for existing policies, not new policies.

Last year, CHOICE called out insurers for avoiding the approved price rise by ‘phoenixing’ – the practice of avoiding the approval process by quietly closing an existing policy, and opening a new policy with the same or similar cover, but with a jacked-up price.

HCF closed its Premium Gold policy to new members and released an almost identical policy with a 34.6% increase in price – and no government price approval required

The Minister for Health and Aged Care Mark Butler followed up with a public slapdown. He described the practice as “underhanded and contrary to the spirit of the law” and called on health insurers to change their behaviour.

Surely the insurers wouldn’t continue policy phoenixing after being called out by the minister of the department that oversees their taxpayer funded subsidies, would they?

Well, not only have they continued, but this year HCF did it on the exact same day the health minister announced the approved 3.73% average annual increase to health insurance premiums for all existing hospital and extras policies.

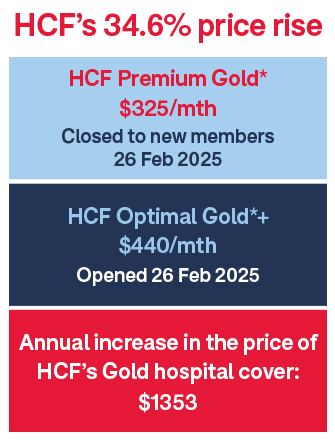

While the health department published HCF’s average fund increase of 4.95%, HCF closed its Premium Gold policy to new members and released an almost identical policy called Optimal Gold with a 34.6% increase in price – and no government price approval required.

HCF’s 34.6% price rise

On 26 February this year, the day the health minister announced the 2025 health insurance increase, HCF released Optimal Gold with a NSW premium of around $440 per month for a single person, and closed to new members its Premium Gold policy that cost $325 per month.

This means the annual increase in the price of HCF’s Gold hospital cover was $1353, or a staggering 34.6%.

The new policy must be purchased with an HCF extras policy, and new customers will now have to pay an excess for day surgery (which was not the case under the previous Gold policy).

HCF blames the high cost of services

HCF justifies the price rises with the increased costs of top-level in-hospital services, and a higher likelihood of people claiming on these treatments.

The health fund says: “Offering affordably priced Gold cover has become increasingly challenging due to the high costs associated with services exclusive to Gold-tier policies, such as psychiatric treatments, weight-loss surgery, fertility treatments, pregnancy, and birth. And Gold policies tend to attract members who anticipate making claims, leading to higher policy pricing due to higher claims costs.”

HCF claims that product phoenixing is a way of managing products to remain financially sustainable

It claims that product phoenixing is a way of managing products to remain financially sustainable.

“Despite these challenges, HCF has worked diligently to offer comprehensive Gold-tier coverage while ensuring fair pricing and continued value for our members. When external factors, such as regulatory changes or evolving claiming behaviours, impact the viability of certain products, HCF reviews them to ensure they remain financially sustainable. This may result in closing certain products to new members and introducing alternative options to manage insurance risk responsibly while protecting the broader membership.”

HCF delivers biggest Gold cover price hike

On top of its brazen phoenixing play, HCF has earned the title of ‘chief health insurance rorter’ for also having the biggest Gold cover price hike of the big five health funds.

But all the funds are doing it. CHOICE research has found that over the past five years, the cost of top-cover Gold hospital policies has skyrocketed far beyond the average government-approved health insurance premiums across hospital and extras policies of 16% over the same period:

- HCF – 97% (NSW)

- HBF – up to 82% (Western Australia)*

- NIB (Qantas) – 72% (NSW)

- Medibank – 68% (NSW)

- Bupa – 56% (NSW)

* We compared Gold-level policies available to new customers in January 2021 with those available in April 2025 in NSW, except for HBF where we used Western Australia, the fund’s largest customer base.

Legal loophole ruled out

No one bemoans a not-for-profit health insurer covering their costs. But when insurers resort to legal loopholes to disguise price increases, then even they must know their price rises don’t pass the ‘pub test’.

So CHOICE welcomes the government’s proposed reform to shut down the policy phoenixing loophole. The government announced in September that it will move towards requiring new health insurance policies to be approved by the health minister.

Australian taxpayers prop up private health insurers to the tune of more than $7 billion annually. Honesty and transparency is the least we should get in return – not health insurers using loopholes to push unfair pricing practices.

Shonky health insurers two years running

Last year, CHOICE gave NIB health insurance a Shonky Award as the worst offender of all the insurers penalising single parents. But as with the phoenixing of policies, all the insurers are doing it, some just do it worse than others.

HCF, for example, prices family policies the same as couples policies. But single parents will pay on average 60% more for an HCF single parent policy than for a singles policy. And HCF Basic Accident Policy charges single parents the same as a couple or family, which means it costs single parents just as much to add their child to the policy as it would to add another adult.

It seems no matter how much ignominy health insurers receive, they’ll keep the system unfair for as long as they keep getting our taxpayer dollars to do it.

More 2025 Shonky Award winners