Brand

Price

Top filters (7)

Versatility score

Ease of use score

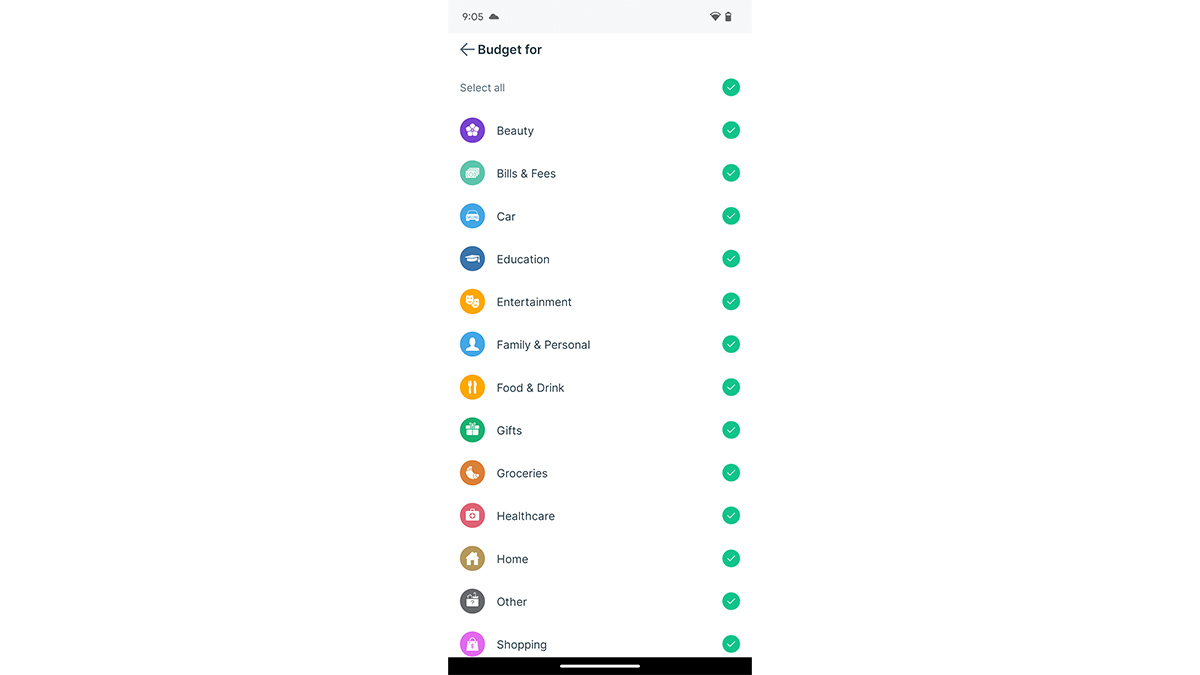

Features (6)

Sort by

Filter by

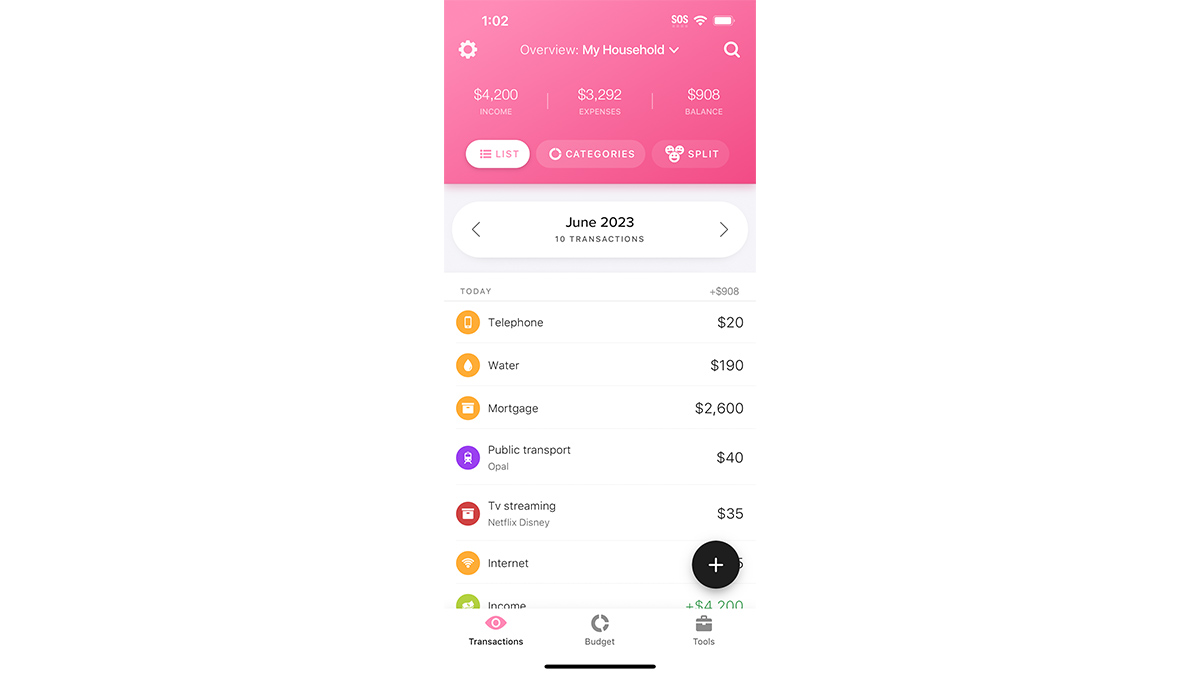

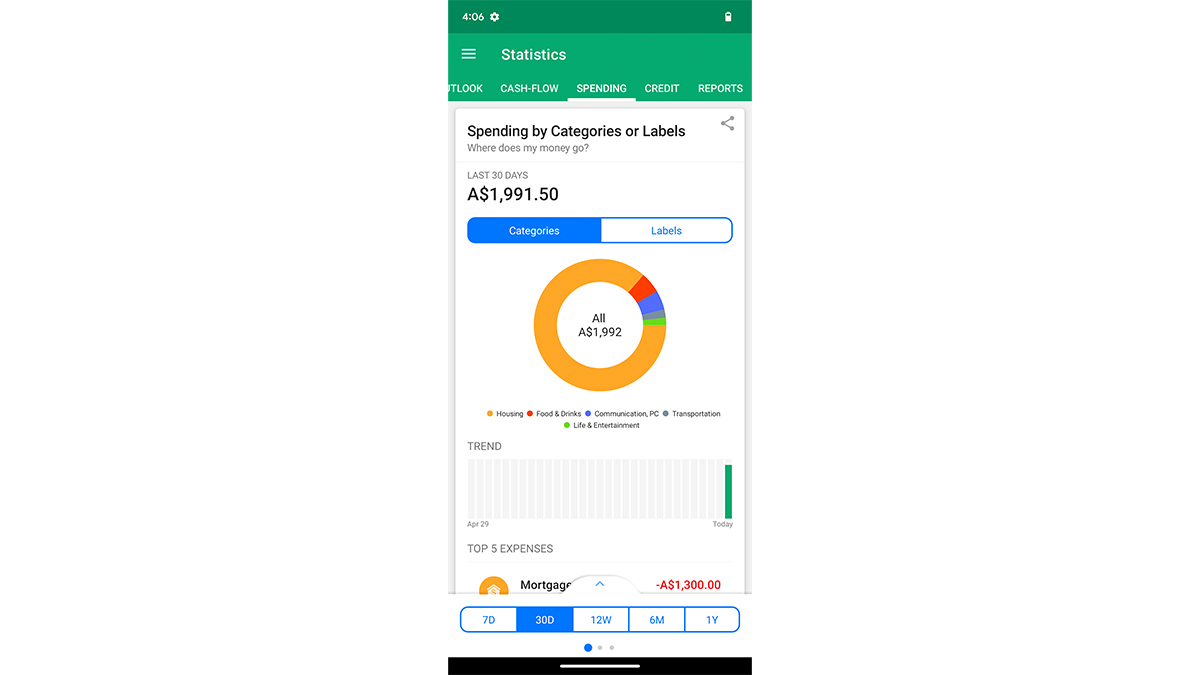

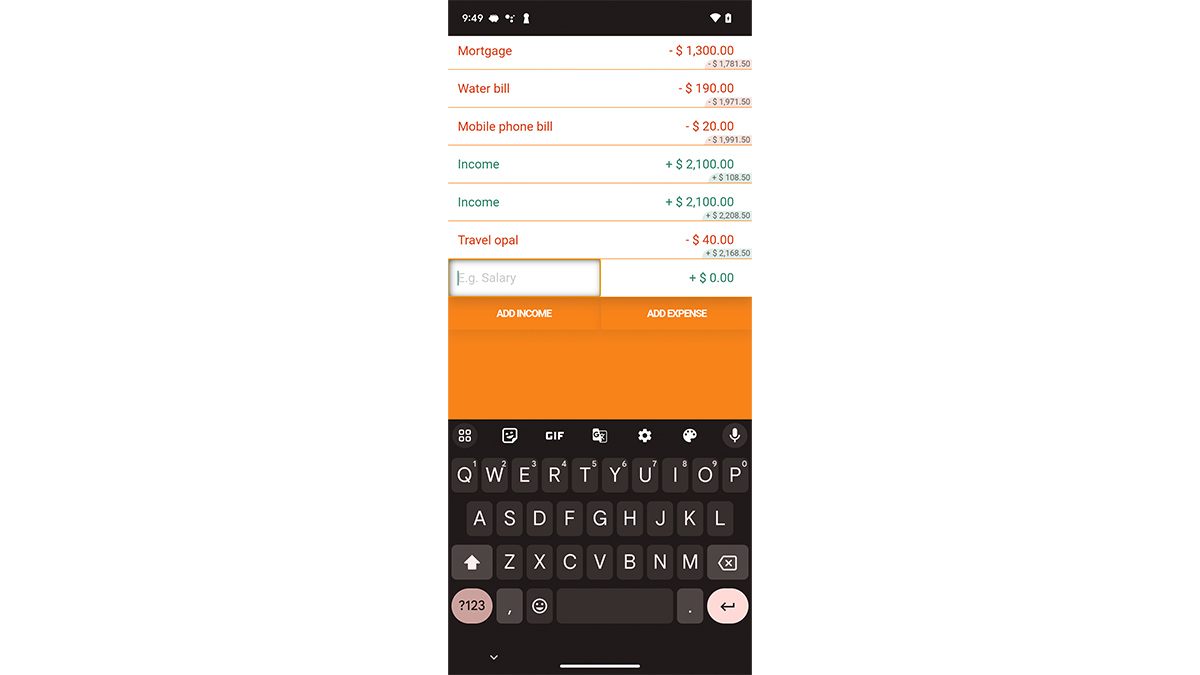

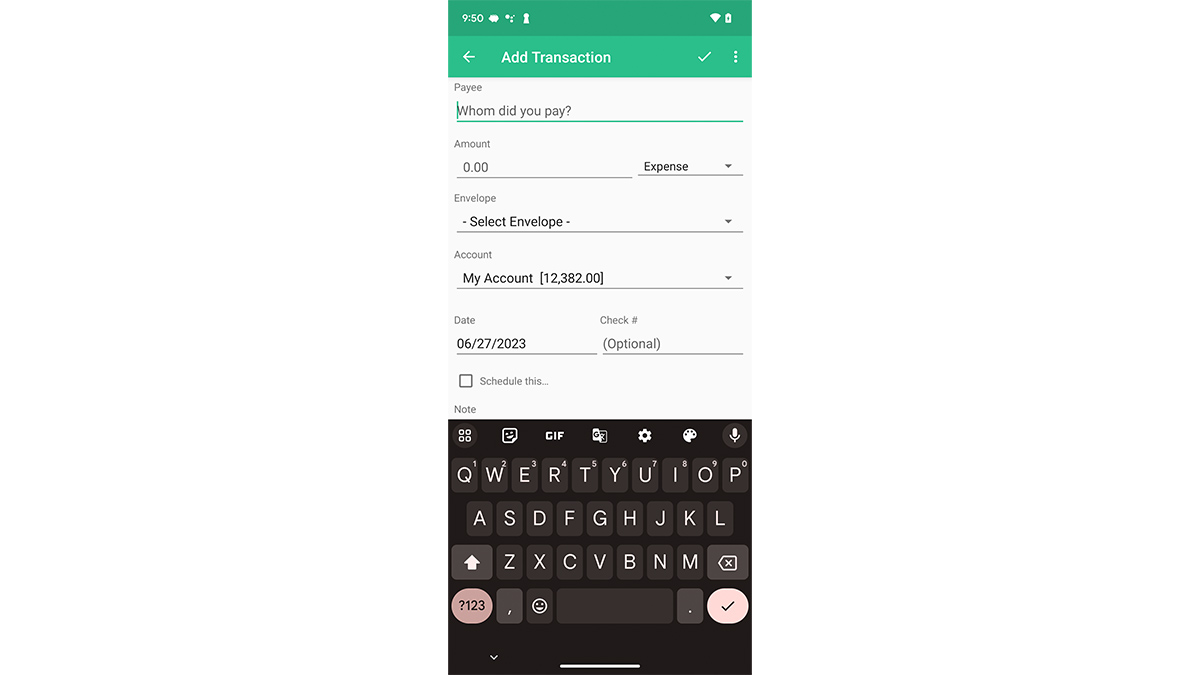

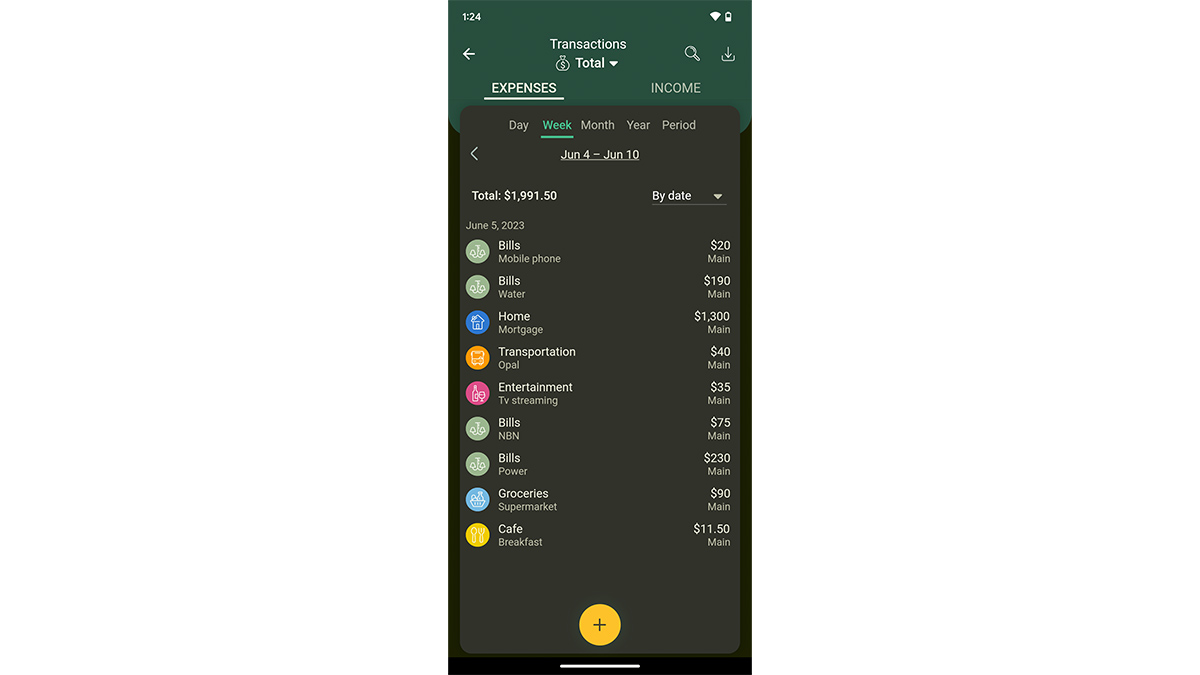

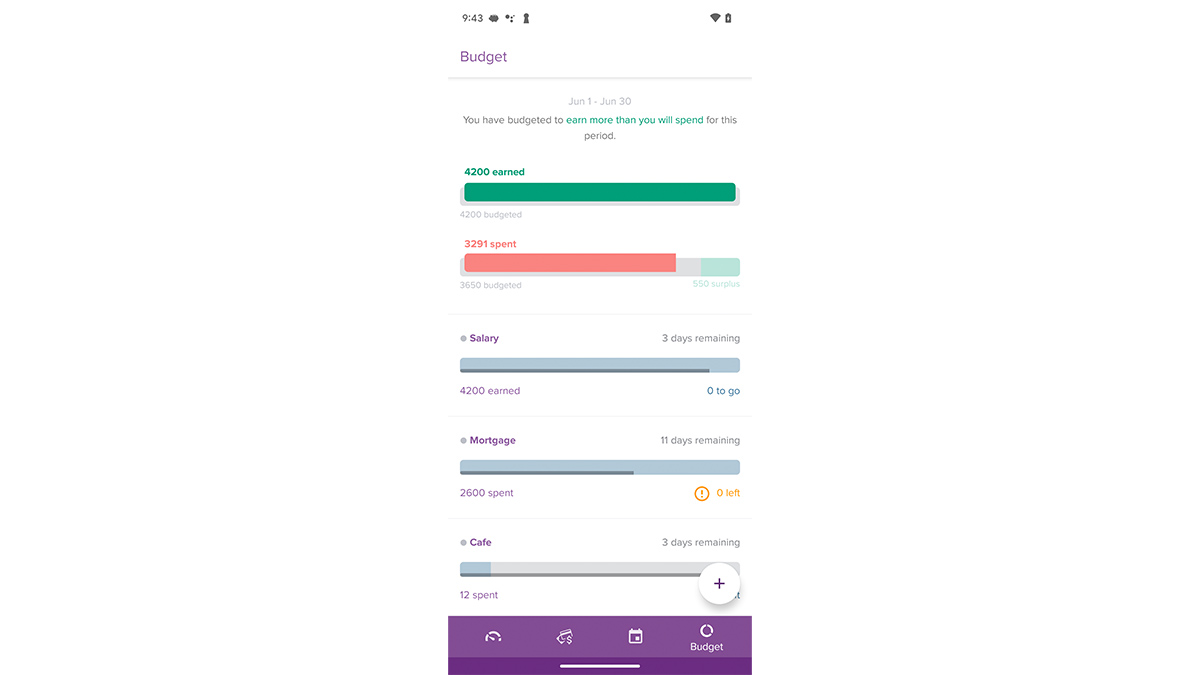

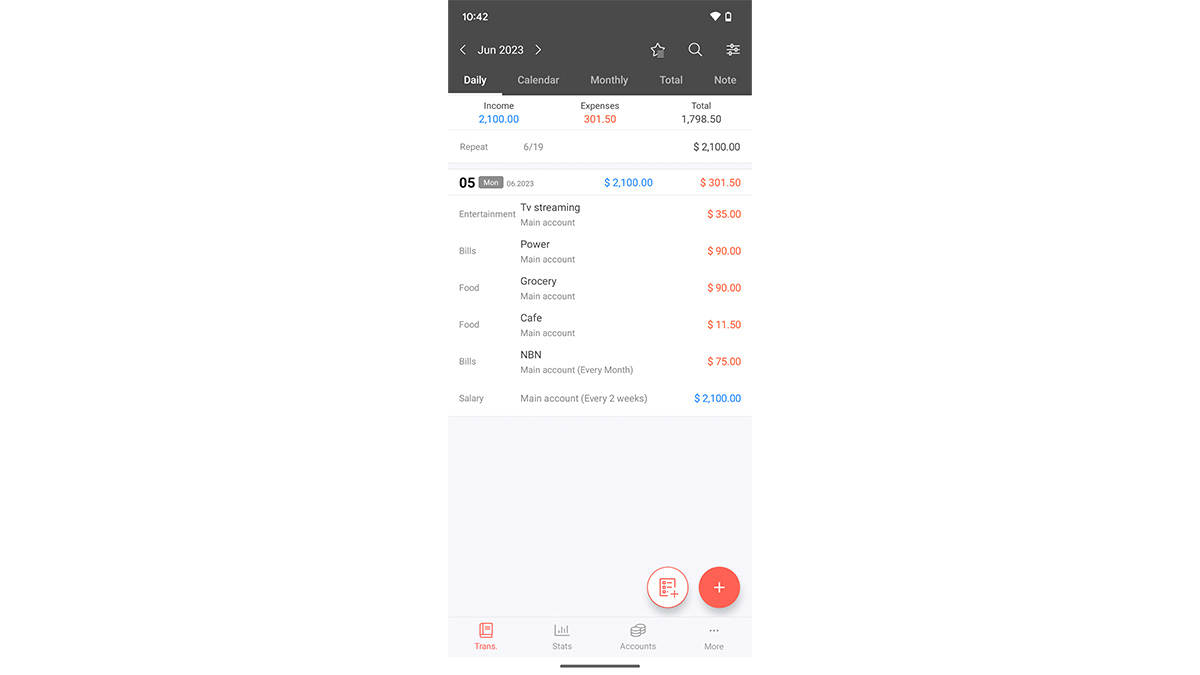

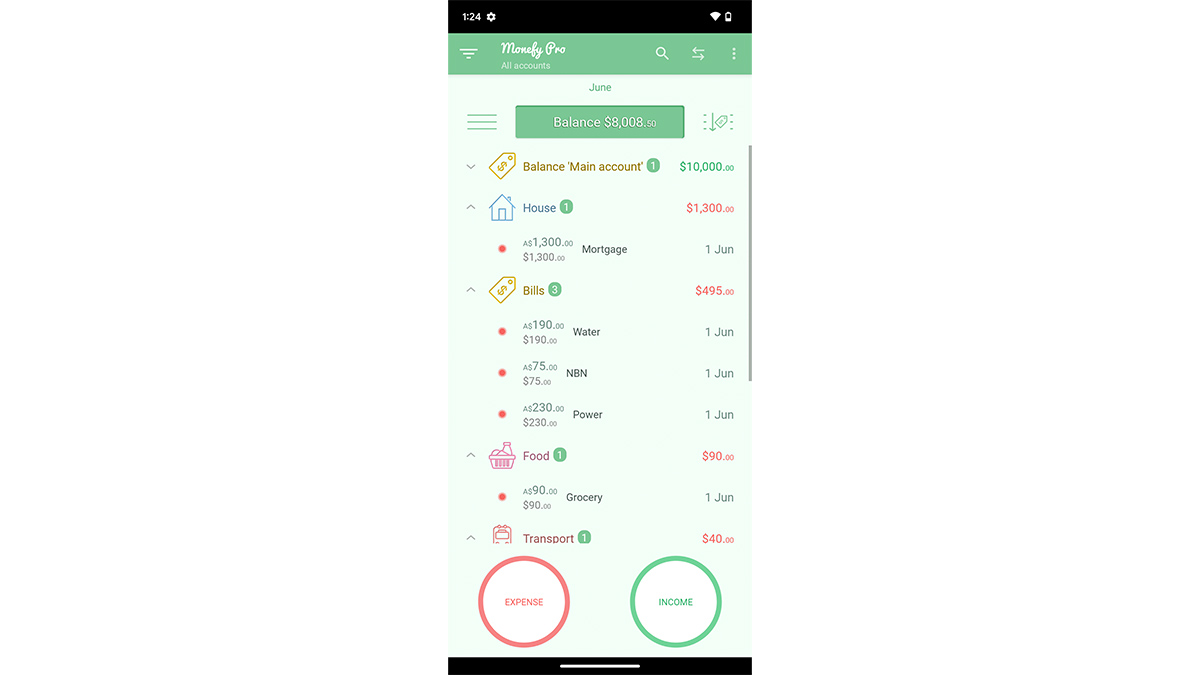

Best budgeting apps

Good budgeting software can help you keep track of your income and expenses with ease.

Our experts put popular budgeting apps for Android and iPhone to the test to find out which ones:

- are easiest to set up

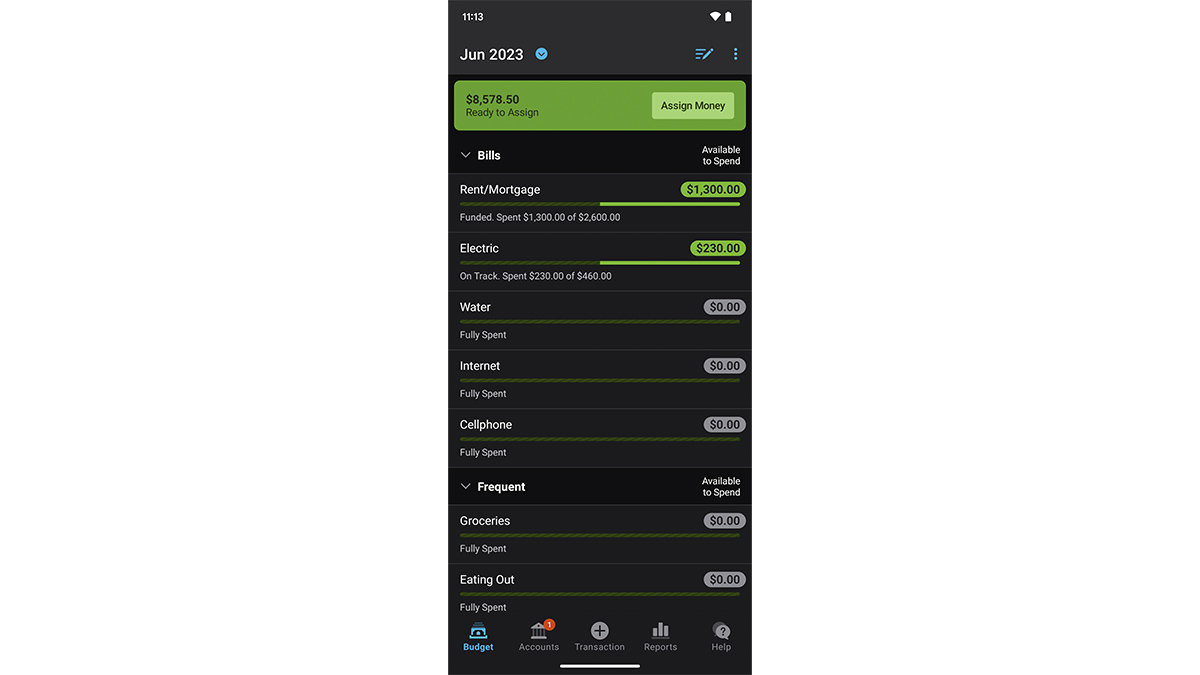

- are the most useful when you want to maintain a long-term budget

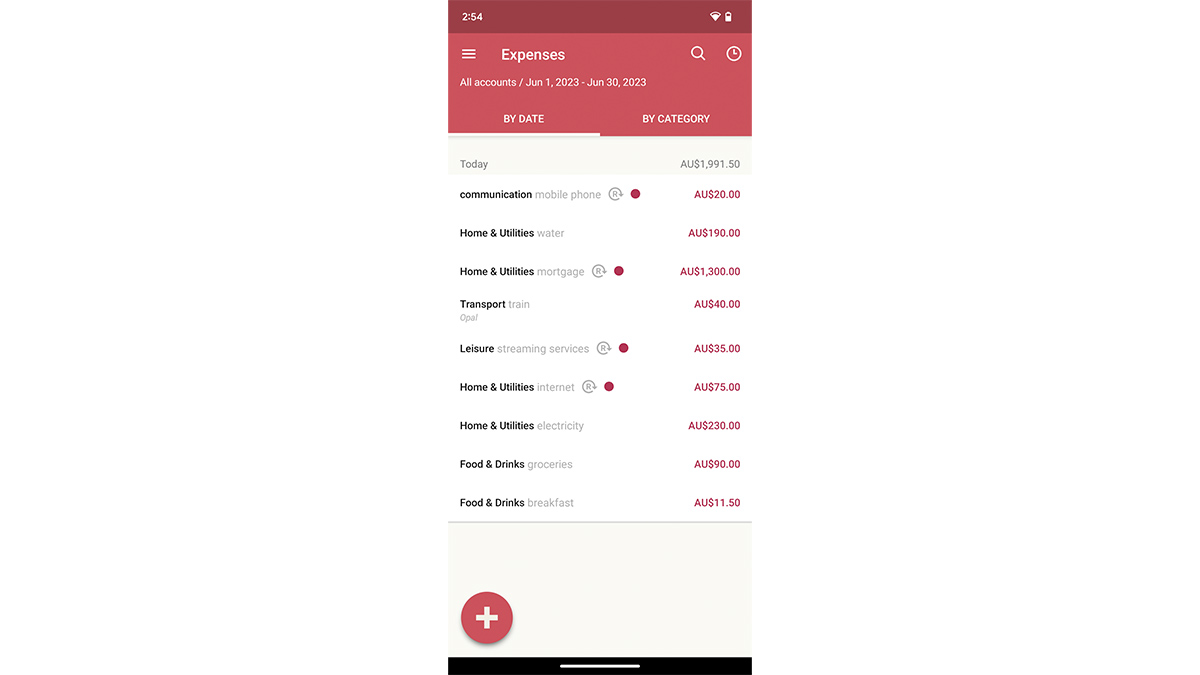

- have the best manual data entry

- can synchronise data between your bank account and the software/app.