Are you missing the full picture on other comparison sites?

See why CHOICE is different.

Why don’t other websites give you the full picture?

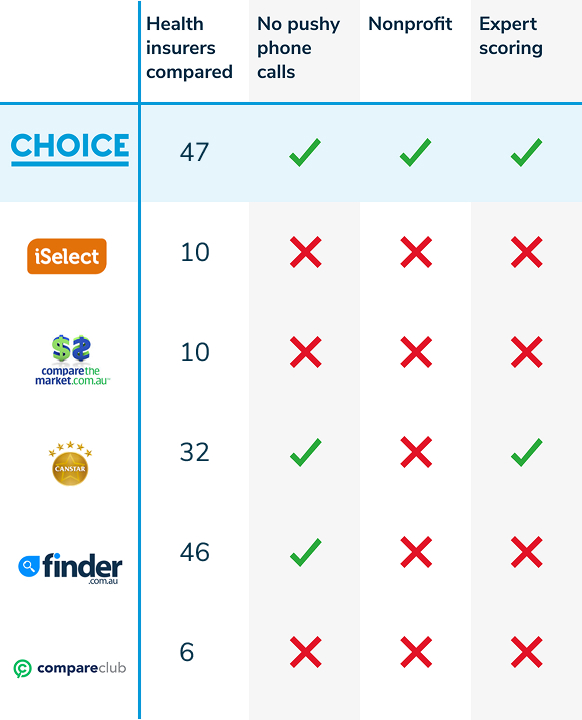

When you buy insurance through iSelect, Compare the Market, or Compare Club, they earn a percentage of the premium. If they don’t get a commission, they won’t show you the policy, even if it’s the best one for your needs.

Canstar and Finder earn fees from participating insurers, which affects what they show in their comparisons. By default they show you only those insurers – you have to uncheck a box to show the insurers that don’t pay them fees.

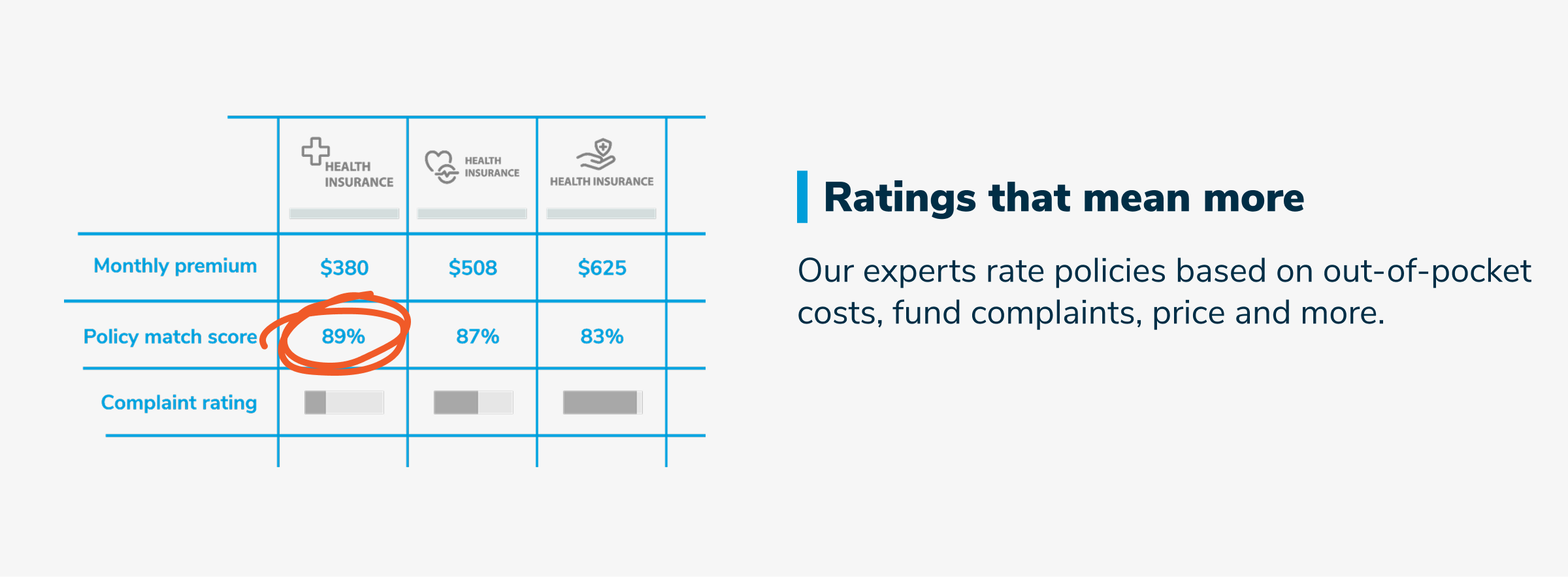

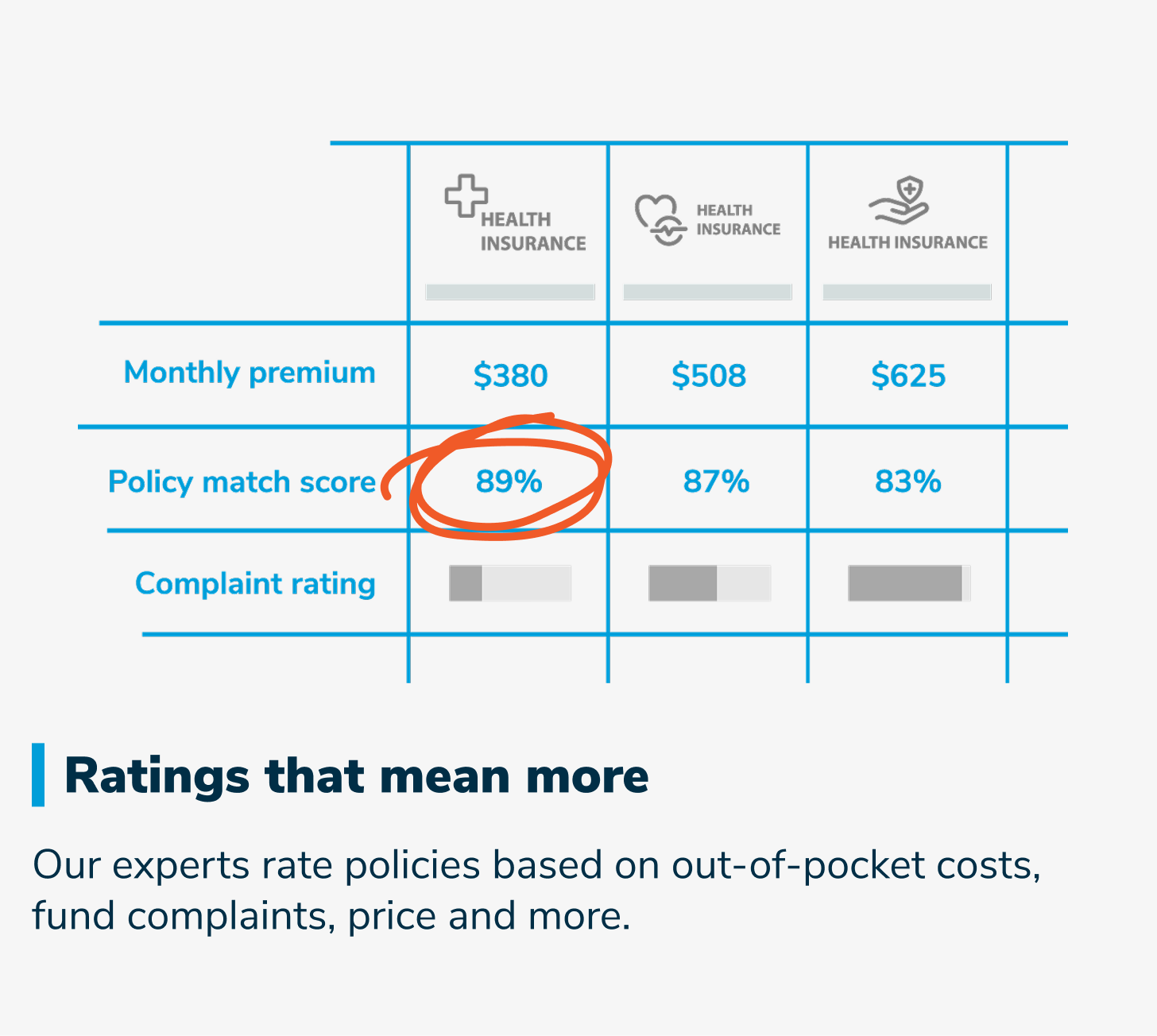

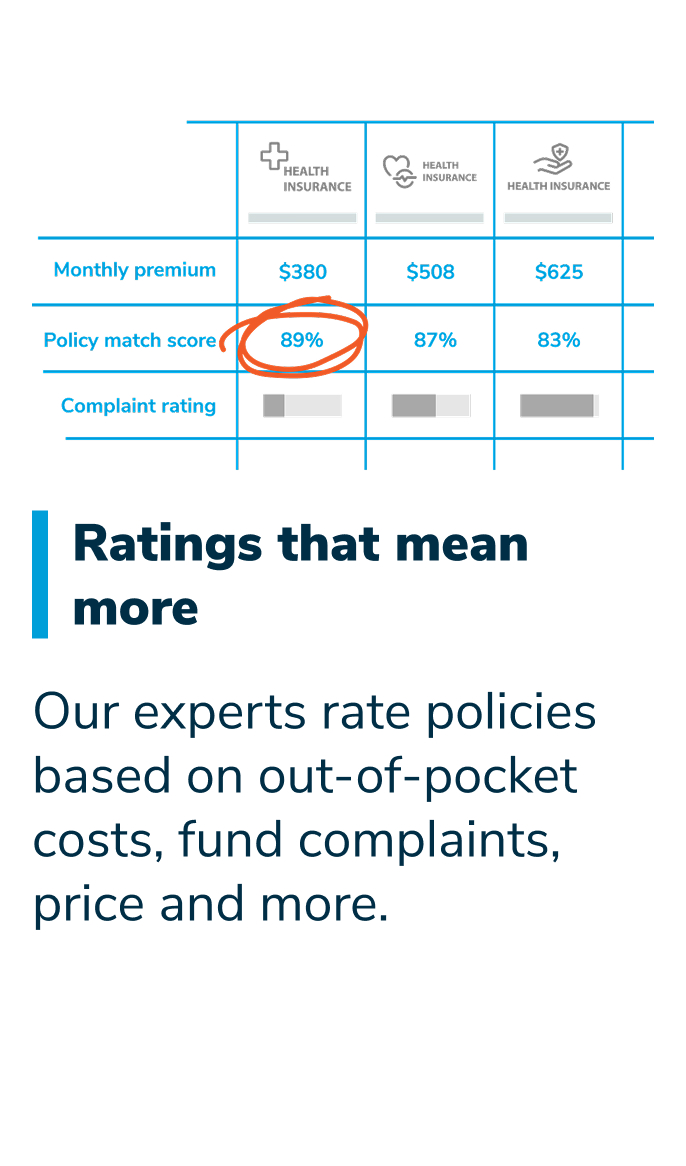

How is CHOICE different? Well for a start, we don’t take commissions from health insurers. You pay us directly to search widely and apply our expert scoring so that we find you the best-value policies that match your needs.

We’re also nonprofit, and we’re not here to make a sale – so you won’t be getting any pushy phone calls or emails from us.

Table updated February 2026. We only include insurers with policies available to purchase as of this date, and no corporate-only funds.

Private health insurance can contribute to what you pay for hospital stays and other health costs like going to the dentist or physio.

It’s an additional cost on top of what you already contribute to Medicare through your taxes but depending on your level of cover, you can choose your doctor, and stay as a private patient in a public or private hospital.

You can buy health insurance that covers both in-hospital costs and out of hospital costs. It typically contributes to the cost of a hospital room and your chosen doctor, but you may also have to contribute extra money out of your own pocket.

Health insurance that contributes to out of hospital costs is usually called ‘extras’, and helps pay for services like dental and optical.

The average yearly cost of private health insurance in Australia, without the highest level government rebate, is $3020 for a single person with a combined hospital and extras policy, or $6530 for a family policy that combines hospital and extras cover. The cost for a couple is often the same as for a family.

Health insurance prices can vary widely depending on the state or territory you live in and the level of cover you buy, as well as which government subsidies and penalties apply to your personal circumstances.

Private health insurance and Medicare cover exactly the same treatments and services. The main difference is in where you’re treated: the public or the private system.

If you’re a permanent Australian resident, Medicare gives you free or subsidised access to doctors and specialists, and treatment and accommodation (the bed or room) in a public hospital. Having a private hospital insurance policy lets you access treatment in the private system. While you’re more likely to have your own room, can choose your own doctor and avoid the sometimes long waiting lists in public hospitals, you’ll also face out-of-pocket costs, on top of your insurance premiums.

A gap is the difference between what Medicare recommends (the Medicare Benefits Schedule fee), and what your doctor or hospital actually charges. You’ll need to pay the difference (the gap), which is why it’s sometimes called an out-of-pocket cost.

Health funds have gap schemes to help cover your out-of-pocket costs, under which they’ll pay all, or part, of the gap. In a ‘no gap’ scheme the insurer sets an upper limit for how much they’ll pay over the MBS fee. If your doctor charges above the MBS but under, or up to, the insurer’s ‘no gap’ threshold, you’ll have no out-of-pocket costs.

An excess is an amount you can choose to pay out of your own pocket, once per hospital stay, in order to lower your premiums. You’ll only pay the excess if you end up going to hospital, so if you don’t expect to go to hospital during the year (you have no surgery planned), choosing a policy with a higher excess could save you money.

The private health insurance rebate is an amount the government contributes towards the cost of your private health insurance premiums.

You can get the private health insurance rebate deducted from the amount of private health insurance premiums you pay to your insurer.

The rebate is means tested, so if your income is higher than the relevant income threshold, you may not receive a rebate. You’ll get a higher rebate if you’re over 65, and higher again if you’re over 70.

A pre-existing condition is an illness or medical condition that you’ve had, or shown signs or symptoms of, in the 6 months before taking out private hospital insurance.

Insurers will make you serve a 12-month waiting period if you apply to be covered for a pre-existing condition, with some exceptions.

Once you’ve served waiting times with one policy you won’t have to serve them again if you switch, even if you have pre-existing conditions.

As you age you’re more likely to need certain types of treatments and surgeries, like cataracts or knee and hip replacements.

If you want to have these in a private hospital, this will only be covered by the expensive, top-tier (Gold and Silver Plus) policies, so keep this in mind when choosing health insurance for seniors.

As you age you’re more likely to need certain types of treatments and surgeries, like cataracts or knee and hip replacements.

If you want to have these in a private hospital, this will only be covered by the expensive, top-tier (Gold and Silver Plus) policies, so keep this in mind when choosing health insurance for seniors.